A resource’s true reliability value is its expected availability to provide energy or reserves when the system is at risk of load shedding. This value depends on (a) the timing of the system’s hours of greatest need and (b) the factors that affect the availability of a resource in those hours. Importantly, the hours of greatest need are affected by the portfolio of generation and the output profile of the portfolio. Since the value of each additional MW is determined in part by the portfolio of existing generation, this value can be characterized as a “marginal value”. Hence, in order for resources to be accredited accurately, RTOs must utilize methods that determine the marginal value of different types of resources.

Intermittent resources are generally accredited using methods that predict the expected output of the resources under different conditions. One such method is the Expected Load Carrying Capability (“ELCC”) used by MISO and others, although its current approach is not marginal.

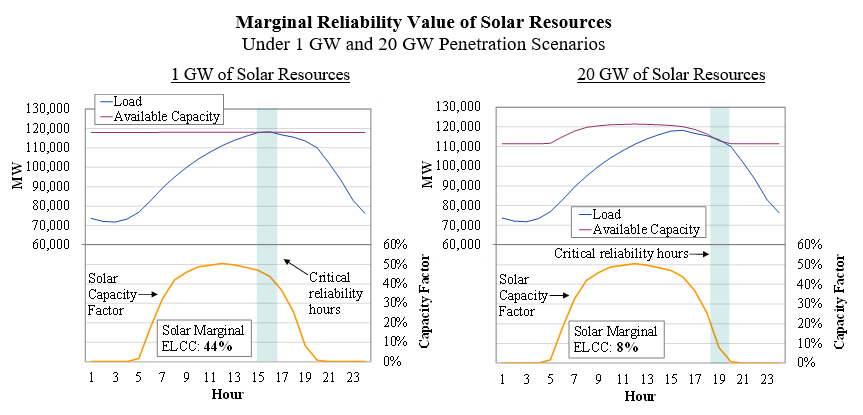

The following figure shows how the increasing penetration of one type of resource with similar output profile can affect the critical reliability hours and alter the marginal ELCC of the resources. This figure shows an illustrative example of the marginal ELCC value of solar resources in a large RTO based on a hypothetical peak summer day based on two different levels of solar resource penetration (1 GW and 20 GW).

This figure shows that in a system with relatively low solar penetration (left panel), critical reliability hours occur in late afternoon when load is peaking and solar output is relatively high. Under these conditions, we estimate a marginal ELCC of 44 percent.

With high solar penetration (right panel), there is abundant available generation in the afternoon, which shifts the timing of critical hours shifts towards the evening. The marginal value of solar falls under these conditions to a marginal ELCC of 8 percent because additional solar generation provides less reliability benefit when critical hours mostly occur in the evening.

The same principles apply to other types of generation, such as natural gas-only resources in the winter. Increasingly, critical reliability hours in the winter are likely to occur when natural gas availability is limited, causing natural gas-only resources that rely on non-firm fuel purchases to provide diminishing levels of reliability to the system. These changes must be reflected in the capacity accreditation framework to ensure that the market will perform well and maintain resources with attributes that are needed to maintain reliability.

If RTOs fail to accredit resources based on their marginal value, the inflated accreditation to low-value (over-saturated) resources will substantially increase costs to consumers and undermine incentives to the high-value resources the system needs. Additionally, accurate accreditation will inform the states’ integrated resource planning processes and ensure that these processes produce resource plans that will satisfy the reliability needs of an RTO.

Marginal capacity accreditation is consistent with the principles that underlie standard RTO market design where all of the RTOs’ market products are priced based on marginal value and marginal cost. In capacity markets, all sellers are paid a marginal clearing price. Hence, it is appropriate and necessary to determine capacity credit values such that an additional unit of capacity from any source provides the same amount of incremental reliability. We continue to believe that the adoption of a marginal accreditation approach for all non-thermal resources is essential for satisfying reliability requirements in well-functioning RTO markets.